Adrian Gill explains: “Annual rent rises in the East are nearly half as fast again as in the capital. It seems like we might have a new hotspot on our hands.

“At the heart of the Eastern region, strong property price growth and some of the best job prospects in the UK combine to make Cambridge fertile ground for rental growth. But one city alone can’t account for the record rate of growth experienced across the whole Eastern region. We also have to take into account the wealth of commuter areas for the capital based there. It may be that we’re seeing an unusually high number of Londoners making the move out to Essex and Hertfordshire, while keeping their London salaries, driving up demand for higher end rental property.

“However, aside from any particular hotspot one trend is clear – nine out of ten regions have seen faster annual growth last month than the month before. Across England and Wales rents are going one way for the time being.”

Rental yields steady but total returns cooling

The gross yield on a typical rental property in England and Wales (before taking into account factors such as void periods) stayed steady in June at 5.1%, the same as the month before as well as June last year.

Total annual returns fell again in June, but only slightly. On average, landlords in England and Wales have seen returns of 9.2% over the year ending June 2015 – down slightly from 9.3% in May and 11.9% in the year ending June 2014.

This means that the average landlord in England and Wales has seen a return of £16,216 in absolute terms, before deductions such as mortgage payments and maintenance. Of this, the average capital gain contributed £7,946 while rental income made up £8,270 over the twelve months to June.

Adrian Gill continues: “Resilient yields backed up by rapid rent rises are a boon for landlords in otherwise trying times. Though the Summer Budget threatens to eat into their profits, record rents should provide buy-to-let investors with some comfort: the fundamentals still make being a landlord an attractive proposal.

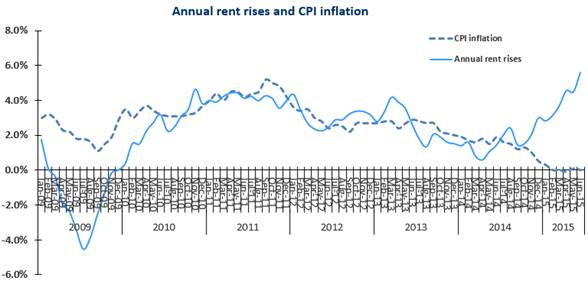

“The fact that rents have risen faster than house prices should reinforce that the primary source of a buy-to-let investor’s income is rent rather than capital gains – house price growth is a welcome bonus, but not the be-all and end-all of rental property investment. Meanwhile, with mortgage rates so low, there’s rarely been a better time to invest in new property.”

Rent arrears higher in June

Tenant arrears made up 8.7% of all rent payable in June 2015, up from to 7.6% of all rent in May, and 7.8% in June 2014.

Adrian Gill concludes: “While any uptick in the proportion of rent in arrears is a step down the wrong path, this should be seen in context. The overriding trend is still towards lower proportions of rent in arrears – far lower than was seen during the financial crisis.

“A certain degree of variation is to be expected – tenants aren’t robots, and bad months happen. The important thing is to ensure that tenants are able to avoid these situations becoming more serious if arrears build up.

“In the long term, if we want more encouraging trends to continue, there needs to be a greater emphasis on what can be done to help tenants and landlords alike. It’s one thing to slap landlords with a tax and call it a done deal, and quite another to address the issue of housing in a consistent and sustainable way. The cornerstone of progress, as ever, is housebuilding.”

Courtesy of LSL.

METHODOLOGY

The index is based on analysis of approximately 20,000 properties across England and Wales. Rental values refer to the actual values achieved for each property when let. Yield figures are unadjusted, and do not take account of void periods or arrears. Annual returns are based on annual rental property price inflation and void-adjusted yield at the point of purchase. These figures are subject to revision as more data becomes available.

This Buy-to-Let Index has been prepared by The Wriglesworth Consultancy for Your Move and Reeds Rains, part of LSL Property Services. It has been compiled using information extracted from LSL’s management information. The copyright and all other intellectual property rights in the Buy-to-Let Index belong to LSL. Reproduction in whole or part is not permitted unless an acknowledgement to LSL as the source is included. No modification is permitted without LSL’s prior written consent.

Whilst care is taken in the compilation of the Buy-to-Let Index, no representation or assurances are made as to its accuracy or completeness. Your Move, Reeds Rains and LSL reserve the right to vary the methodology and to edit or discontinue the Buy-to-Let Index in whole or in part at any time.