Egypt

"Today marks the beginning of the final stages of the construction of the New Suez Canal," said Admiral Mohab Mameesh, Chairman, Suez Canal Authority. "On August 6, Egypt will present to the world a gift that will not only contribute to global commerce, enriching the services of the Suez Canal, but also improve people's lives by contributing to employment, logistics, trade and more. The New Suez Canal is not only a waterway; it's a symbol of the new Egypt and a catalyst for the Egyptian people."

Today, the world witnessed history, as the first successful double crossing of the canal. One of the ships has net tonnage of 133000. Three ships entered the new canal through the Ismalia entrance at 10am local time, carrying a combined tonnage of 305k. The event marks the first time ships have simultaneously navigated the Suez Canal's waterways since its inception more than a century ago. The transiting of the vessels prior to the official unveiling of the New Suez Canal demonstrates Egypt's capability of realizing its goal of opening the new canal within 12 months of construction.

The first three ships included Apl of Southampton, traveling from Jeddah to Port Said, Maersk Cheerness of Luxembourg, traveling from Singapore to the United States of America, and Mayssan of Bahrain, traveling from Jeddah to Italy.

Qatar

The General Directorate of Nationality, Borders and Expatriate Affairs (GDNBEA) at the Ministry of Interior (MoI) has started issuing new Residence Cards instead of Residence Permit (RP) stickers in the passports of residents. "The new residence card holds several security features that should not be tampered and cannot be faked as well as it carries data of the card holder," said Brigadier Mohamed Saleh al-Kuwari, head of the Residence Division at GDNBEA. "The advantages of the new system include speedy completion of transactions because passports are not needed for sticker printing," he explained.

The official was of the view that the number of customers visiting the GDNBEA service centers will decrease dramatically as they could renew the RP online and choose the delivery service through Q-Post. "The GDNBEA and Q-Post are working in co-operation to deliver the cards through mail to the customers who renew the RP online," he said.

Captain Abdullah Khalifa al-Mohannadi, from the technical office of the GDNBEA, said the new method was implemented following long-term research.

"A set of services will be delivered through the new card in the near future," he explained.

In case of any damage to the residence card, it should be surrendered for reissue with the same fees. But if the card is lost while the holder is abroad, a lost report should be published, the authority concerned abroad informed and the relevant documents brought to Qatar to issue a new card. The person will be granted a return visa through the request of the employer. If the card is lost inside Qatar, a new card will be issued once the loss is reported to the authority concerned.

Hamad al-Kuwari, head of the Premium Customers Division at Q-Post, said that an agreement has been concluded with the MoI to start the delivery of residence cards to companies and individuals. "Almost 4,000-8,000 cards will be delivered daily to companies and individuals," he said. The agreement is similar to the one Q-Post has with the General Directorate of Traffic to deliver driving licenses and vehicle registration cards processed through Metrash2 service. Q-Post has three types of delivery services. The first is a monthly subscription of QR1,500 for companies having 1,000 to 10,000 workers. The second system is delivery of cards with a fee of QR100 for every 10 cards, while the third is for one to four cards at QR20 per card.

The cards are delivered within 24 hours inside Doha and 48 hours elsewhere in Qatar at present. "We are trying to deliver the cards on the same day," the Q-Post official added.

Other Qatar

Qatar has unveiled plans for the biggest industrial and logistic project in the southern part of the country featuring more than 1,850 plots stretching across 6.3 million sq m of land, a report said.

The project, which will feature assembling units, storage units, showrooms and shops, commercial offices, labour camps, workshops, warehouses , service centres and depots, will be developed in Al Wakra, Birkat Al Awamir and Aba Salil, reported The Peninsula.

An infrastructure network of roads, electricity and water connections, as well as a fire brigade, civil defence, vehicle parking, supermarkets and pharmacies will support the project, the report said.

The annual cost for investors will amount to QR40 ($10.9) per sq m, while the long-term lease contract will be for 30 years and rents will be required to be paid every six months.

About 950 plots ranging from 1,000 sq m to 2,000 sq m will be allotted to small investors, whereas medium investors will be offered plot ranging from over 2,000 sq m to 67,557 sq m.

The project was unveiled yesterday (July 15) by Prime Minister and Interior Minister Sheikh Abdullah bin Nasser bin Khalifa Al Thani, who said the project aims to diversify Qatari economy and encourage the private sector's competitiveness, leading to increased commercial activities.

The government plans to launch several mega projects to boost and diversify the national economy with the help of the private sector to reduce the country's dependence on the hydrocarbons sector, the Prime Minister was quoted as saying in the report.

The project is near Hamad Port, Mesaeed Industrial Area and Orbital Road.

The committee will accept applications for investment from all investors from August 2 to November 9, the report said.

Bahrain

Unused plots of land in some of Bahrain's most congested areas could soon be hired out on a monthly basis for use as car parks, a report said.

The Capital Trustees Board is already compiling a list of empty plots in areas such as Seef and Juffair, prior to negotiating lease rates with landowners, reported the Gulf Daily News, our sister publication.

It follows numerous complaints from residents and visitors to the governorate about cars parked on the roads or on pavements due to lack of space.

"The car parking situation in some areas, notably Juffair and Seef, needs rectifying as it is leading to access being blocked while encouraging improper parking," board acting chairman Mazen Alumran told the GDN.

"It is very difficult to purchase plots of land due to a limited budget, while asking ministries or government bodies to move things around also takes time.

"But the board could lease plots owned by the government or endowments directorates within days, while we will negotiate with private owners to lease their plots for around BD500 a month.

"Of course, we will be willing to give up the land whenever landowners decide they want to build - hopefully by then we will have found permanent solutions to the congestion."

Meanwhile, Alumran said there were plans to bring in new regulations regarding obligations for developers in relation to car parking.

"We believe that the current parking spaces required from developers is not enough, with just one space required per apartment in residential projects and two per shop in commercial ones," he said.

"More parking spaces should be incorporated into projects - it is no good having services on offer when it is difficult to reach them.

"The issue is under study and could see new regulations introduced regarding the number of car parks that should be provided." - TradeArabia News Service

UAE

The United Arab Emirates said it would let domestic fuel prices move more freely in a politically sensitive reform that could save the government billions of dollars and begin reducing the country's love of gas-guzzling cars with big engines.

Gasoline and diesel will be deregulated from August 1 and a new pricing policy linked to global levels will be introduced, state news agency Wam quoted the energy ministry as saying on Wednesday.

"Deregulating fuel prices will help decrease fuel consumption and preserve natural resources for future generations," said energy minister Suhail bin Mohammed Al-Mazroui.

"It will also encourage individuals to adopt fuel-efficient vehicles, including the use of electric and hybrid cars."

Matar Al-Nyadi, undersecretary of the ministry and chairman of its new Gasoline and Diesel Prices Committee, told Reuters that gasoline prices might initially rise slightly because of the reform, while diesel would fall.

At present, state subsidies keep gasoline and diesel in the Arab world's second biggest economy at some of the lowest prices in the world. Motorists pay 47 US cents for a litre of gasoline, less than a third of levels in western Europe.

Cutting subsidies and letting fuel prices rise could boost UAE state finances, which have been weakened by a plunge of oil export revenues since 2014 due to the fall in global crude prices.

The International Monetary Fund projects the UAE will post its first fiscal deficit this year since 2009; it estimates the country spends $7 billion annually on petroleum subsidies.

The ministry's statement did not give details of the new pricing policy, beyond saying the prices committee would announce on the 28th of each month prices for the following month, basing its decision on "average global prices with the addition of operating costs".

The global price of Brent oil is currently around $56 per barrel, not far from six-year lows. But linking UAE prices to global levels could clear the way for substantial hikes in the future, if Brent starts to recover.

Al Mazroui said fuel price changes would not raise the UAE's cost of living significantly, while diesel's expected fall next month would help the economy.

"This will stimulate the economy as a lower diesel price would mean lower operating costs for a wide number of vital sectors like industry, shipping and cargo among many others."

The announcement put the UAE at the front of economic reform among the Gulf oil states. Other governments are grappling with similar financial pressures but have mostly not had the political will to push through major change.

Kuwait raised its domestic diesel and kerosene prices in January but partially reversed the hikes a few weeks later after criticism by some members of parliament.

Abu Dhabi, the biggest emirate in the UAE, hiked electricity and water tariffs in January as part of efforts to cut subsidies. -Reuters

UAE other

Dubai's Roads and Transport Authority (RTA) has announced the completion of connecting all traffic signals in the emirate (408 junctions) with the Traffic Control Center using 3G technology.

The isolated traffic signals have been linked through wireless technology, thus accomplishing the shifting of traffic signals' connectivity in Dubai from cables to wireless systems via this technology, said a senior official.

"The project is part of Dubai Government's initiative to transform the emirate into a smart city. It involves replacing the cables used in linking light signals with the Traffic Control Center in Dubai by a wireless network, besides linking isolated signals with the center using 3G technology," explained Maitha bin Udai, the chief executive of RTA's Traffic and Roads Agency.

"The new system has high usability and efficiency, and is easily maintained. It eliminates the lag in the timing of light signals, and is considered cost-efficient compared to the previous situation, which required an intensive infrastructure in terms of cables, telephone lines to run the service nearby each signal," she stated.

"Thus, the project saves the cost of providing these lines along with the risks of losing connectivity in case of any technical glitches or physical malfunctioning that reflects positively on streamlining the control of light signals through the control center," she added.

According to her, the benefits of the new system include remotely controlling the timing of light signals and managing them to cope with the changes in the traffic flow, which translates into low congestions at junctions.

"Moreover, the system enables diagnosing, managing and synchronization of the timing of the Cableless Linking Facility (CLF) plans to ensure the efficient and optimal functioning of the traffic signals control systems. If there is a need for additional traffic signals, they can be easily and quickly linked with the Control Center at a cost lower than previously incurred when telephone lines were used, she added.-TradeArabia News Service

Other UAE

Mohammed Bin Rashid Al Maktoum City, a community destination and prime residential location in Dubai, UAE, will see the development of a Dh1-billion ($272.2 million) luxury residential project titled 'Jade at the Fields.'

The project, to be developed in the District 11 of Mohammed Bin Rashid Al Maktoum City, is being sold and marketed by SPF Realty, a leading real estate broker in the UAE's freehold property sector, said a statement.

'Jade at the Fields', a gated residential community consisting of 360 premium townhouses of contemporary style, is expected to break ground by mid-2016.

G&Co has appointed SPF Realty for Jade at the Fields project as a continuation of their successful association after receiving overwhelming response for its previous two projects - the Dh1.5 billion ($408.39 million) Millennium Estates, and the Dh2.7 billion ($735 million) Grand Views at Millennium Estates, both of which were exclusively marketed and sold by SPF Realty.

Kalpesh Sampat, director of SPF Realty, said: "Jade at the Fields is set to be the first choice for property investors in Dubai market, with demand for premium homes in the city increasing. With this prestigious project, we aim to meet the high demand for a project with all the perfect elements that the market demands.

"The sprawling green gardens and picturesque landscaping of Jade at the Fields community will be home to 360 spacious townhouses of three and four bedrooms. This community is set to offer a community pool and gym, retail space, landscaped garden, parks and kids play area, and other modern amenities."

"The off-plan freehold properties - three- and four-bedroom townhouses - are offered at low prices per sq ft, with a starting price of Dh2.26 million ($615,000), and 35 per cent of the property value is payable easily in half yearly instalments over a period of 30 months," said Sampat.

"The payment plan allows the buyer to book the property at a five per cent down payment (plus four per cent Oqood), and six per cent payment every six months until completion of the project. Payment of the next 15 per cent of the property value is payable on handover of the property, and the remaining 50 per cent is payable in quarterly installments over three years after handover of the property. Ground-breaking of the project will be made in the first half of 2016, and its completion is expected in the third quarter of 2018," he said.

The Mohammed Bin Rashid Al Maktoum City is a multi-billion-dollar city project, which will include the world's biggest shopping mall, a universal family theme park and a park that is a third bigger than Hyde Park in London, said the statement.

'Jade at the Fields' has a serene setting at the heart of the Mohammed Bin Rashid Al Maktoum City, inspired by the greenery and openness of nature infused with a subtle oriental influence, it said.

Investors of any nationality, irrespective of their residency status, can buy properties in Jade at the Fields. The property purchased by an expatriate will be put in his/her name for life, which will allow the buyer to register the property in Dubai Land Department.

The owner will then have full rights to the property, including the right to sell, lease or rent it at his/her own discretion. This property can also be inherited, in line with Dubai Government laws, it added. - TradeArabia News Service

Saudi Arabia

Saudi Arabia's Haramain High-Speed Railway network has been connected with electricity for its overhead lines and is expected to link King Abdullah Economic City (KAEC) and Madinah at the end of 2015, said a top official.

The train has been tested on the line with a speed of 300 km per hour, Abdullah Al-Muqbil, Saudi Arabia's Transport Minister and chairman of the Saudi Railways Organization (SRO), was quoted as saying by Arab News.

Tests will continue for a few months until the efficiency of the train is verified, the minister said.

The project includes railway lines with a total length of 450 km between Makkah, Jeddah and Madinah, the report said.

Train stations will be established in central Jeddah, King Abdul Aziz Airport in Jeddah, Makkah, Madinah and King Abdullah Economic City in Rabigh.

Kuwait

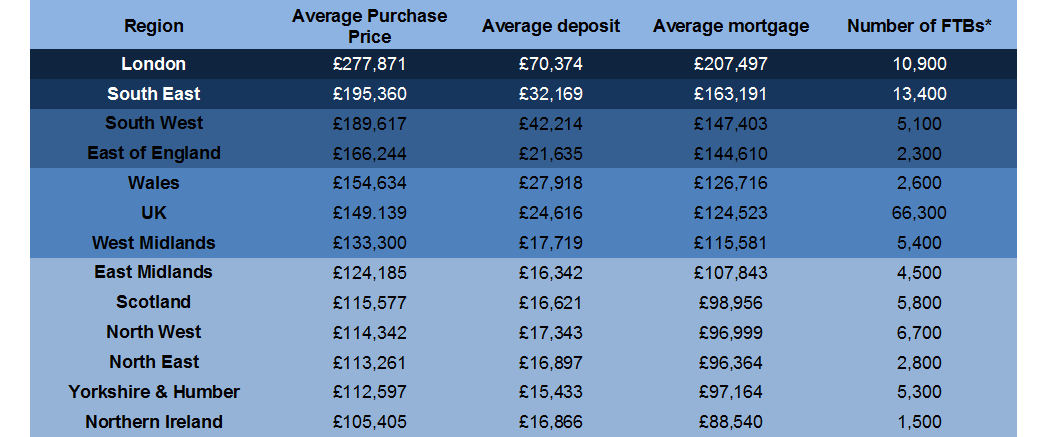

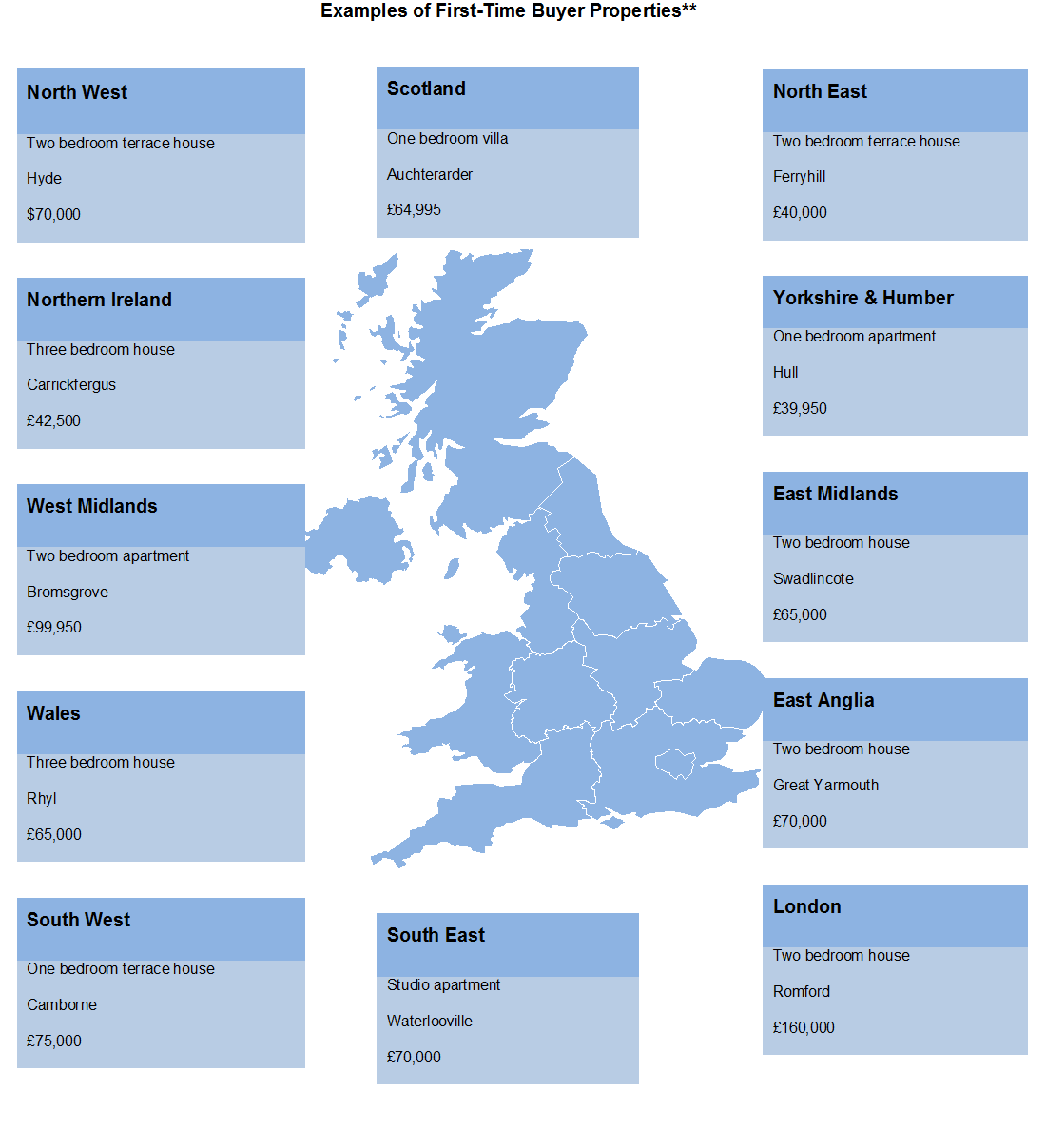

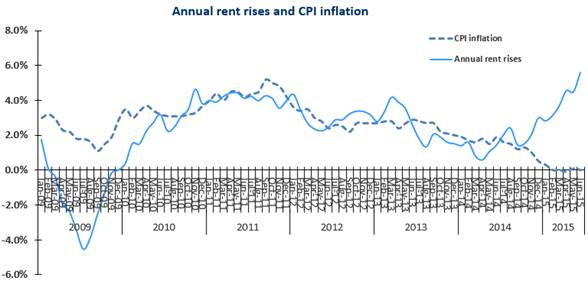

Offshore bank Skipton International has extended its UK buy-to-let mortgages to British expats currently living in Kuwait. It's one year since the bank first launched the lending products, which have attracted a lot of interest from the Gulf region.

Obtaining a buy-to-let mortgage as a British expat isn't easy, a need identified by Skipton, which has been serving deposit account customers in more than 100 countries around the world for nearly 20 years.

Director of Lending at the Channel Island bank, Nigel Pascoe, said, 'We pride ourselves on our personal service and work hard to ensure we are offering customers what they need. That's why after a lot of interest from the Gulf region, we decided to open up these mortgages to Kuwaiti based British expats. We have also recently extended these mortgages to retirees as we know people are eager to take advantage of the long-term price inflation seen in the UK housing market, and keen to diversify their portfolios with the potential for further economic uncertainty.'

Skipton has also created a mortgage calculator to help show prospective landlords how much they might be able to borrow on a property (www.skiptoninternational.com/mortgages/expat )

Other Kuwait

KUWAIT CITY: The Public Relations and Security Media Department of Ministry of Interior announced that the General Department for Residency Affairs has decided to reduce the validity of entry visas to one month instead of three months from the date of its issuance. According to a press statement issued by Ministry of Interior, the decision will come into effect from Tuesday, July 14.

With the implementation of this decision, the recipients of the entry visas must enter the country within one month from the date the visa was issued; after one month, the visa will be nullified. The Public Relations and Security Media Department urged citizens and expatriates to note the expiry date of the visas, affirming that such a decision is aimed for the good of the country and the legal procedures applied in this regard.

KUWAIT: The Ministry of Interior's Assistant Undersecretary for Citizenship and Passports Affairs Major General Sheikh Mazen Al-Jarrah said yesterday that expatriates will only be allowed to issue dependency visas for their wives and children from henceforth. "Expatriates' dependency visas for parents will be stopped.

Dependency visas will be restricted to wife and children," he said. Meanwhile, a new mechanism for family visit visas has been announced.

From now on, the duration of a visit visa issued for a wife or child will be limited to three months only, while visit visas for relatives will be restricted for one month, Jarrah announced yesterday.

Also, a visitor must now enter Kuwait within a month after the issuance of the visit visa - or it will be canceled. Before now, a visit visa would be valid after three months of issuance.

In another development, Jarrah announced that expatriates will no longer be required to leave the country if an absconding case was filed against them, saying that the General Investigations Department will be assigned to examine his appeal and decide whether to allow him to stay in Kuwait.

Jarrah added that Interior Minister Sheikh Mohammad Al-Khaled Al-Sabah is likely to review a study on increasing expats' fees to the parliament during the next parliamentary term.