First-time buyers compromising on quality: a fifth (20%) are prepared to purchase a property with no electricity; 19% willing to forgo plumbing & central heating

In the quest to save for a home, first-time buyers are making serious cutbacks: a sixth (17%) would sacrifice their pension contributions, and 70% would scrap buying a new car or a holiday

Despite these savings & slipping standards, less than a tenth of all tenants (8%) expect to buy by the year’s end – half that of a year ago

Completed monthly transactions fall 27% year-on-year in June, as the political after-shocks of the General Election continue to unsettle the housing market

Despite making large compromises on quality, and serious cutbacks to save for a home, the proportion of tenants expecting to buy by the end of the year has halved compared to a year ago to less than 10%, according to the latest First Time Buyer Opinion Barometer from Your Move and Reeds Rains.

In June, only 8% expected to buy before the end of 2015 – down from the 16% who said, in June 2014, that they expected to buy before the end of 2014.

The survey also revealed that almost one-fifth of first-time buyers are willing to go without basic utilities in order to purchase a home. When asked what features they would forgo in their first home, 20% of first-time buyers responded that they were prepared to go without electricity, while 19% were willing to put up with no working plumbing and central heating.

The proportion of buyers willing to compromise increases dramatically when questioned about less essential household features. Dated décor and a sub-par kitchen were acceptable set-backs for owning a first home for 77% and 76% of new buyers respectively, and 71% said the same of an out-of-date bathroom. Only 9% of respondents claimed they were unwilling to make any significant compromise when buying their first home – below the proportion of first-time buyers willing to accept a property with dry rot (12%) or one with a leaking roof (14%).

The willingness of first-time buyers to compromise on the quality of their new home is confirmed when they were asked what condition of property they were looking to buy. The largest proportion – 45% – conceded that they would accept a property of any condition, so long as it was within their budget, despite only 15% of respondents claiming that they were actively seeking to buy a home which required renovation.

Home-ownership still remains the aim for most people in the UK, with 91% of tenants aspiring to be home-owning at some point in their lives.

Adrian Gill, director of estate agents Your Move and Reeds Rains, comments: "As demand in the property market remains strong, first-time buyers are willing to accept a home in less-than-perfect condition.

"While the stats seem alarming at first glance, they’re a good sign for the housing market overall. The figures show that most would-be first-time buyers haven’t given up on the dream of property-ownership. Instead, they are sensibly adjusting their expectations and preparing themselves for some of the short-comings that may be present in a first home. Indeed, it may even be the case that some first-time buyers actively select properties with faded décor or faulty kitchens, judging that the reduction they can secure on the asking price is greater than the cost of any required renovation work.

"First-time buyers are also still taking advantage of Government-backed schemes, such as Help to Buy, while they last. Home-buying incentives are not going to be around forever – especially now the property market is beginning to stand on its own two feet. First-time buyers are more inclined to purchase a home now with support – even if it doesn’t match exactly to their specifications – than hold out for a more ideal property and risk the incentives expiring."

THE LIFESTYLE COST OF HOME-OWNERSHIP

Large numbers of first-time buyers are willing to slash their outgoings to save up for a home. When asked which of their expenses they would be cut in aide of becoming a home-owner, 69% replied that they would give up purchasing a new car, while 67% stated they would curtail their holiday expenditure.

Many first-time buyers were also ready to slash more day-to-day expenses. Almost two-thirds (61%) opted to slash entertainment expenses such as eating out and 56% went so far as to save on consumer purchases such as clothes.

Some were even prepared to put at risk their financial security in retirement, with 17% of respondents claiming they would sacrifice their pension contributions in aide of owning their own home. Only 12% were unwilling to make any form of accommodation to their lifestyle.

The news comes alongside the survey’s findings that immediate cash-concerns are increasingly the biggest factors stopping tenants stepping onto the property ladder. In June 2015, 68% of tenants claimed that they were currently unable to buy a home because they lacked the required funds for a deposit, whereas just 46% gave the same reason in June last year. Not having enough money to make monthly mortgage payments was cited as an impediment to home-owning by a quarter (25%) of respondents this month, compared to only 15% who saw it as a barrier during the same month last year.

Meanwhile, 16% said that concerns about an interest rate hike was stopping them buying their first home – up from 10% in June 2015 and a figure which has been steadily increasing since the turn of the year. The figure’s growth correlates with increasingly strong signals from the Bank of England that an interest rate hike is likely to occur in the near future.

Adrian Gill, director of estate agents Your Move and Reeds Rains, explains: "First-time buyers are going that extra length to get the capital together to step foot on the housing ladder.

"At a time when wage increases are only just beginning to outstrip inflation and the costs of moving remain stubbornly high, first-time buyers are sadly faced with little option than to make compromises in their lifestyle in order to get the keys to their first home. But it’s not all doom and gloom. The Chancellor’s announcement in his Summer Budget of a National Living Wage is an indicator that the UK’s pay prospects are expected to pick up over the next five years. This should help ease some of the expenditure cuts first-time buyers are having to make. The Budget also contained proposals to use under-utilised public land to build 100,000 new homes – if implemented this policy should take some of the pressure off Britain’s inadequate housing stock. The construction of more affordable housing would leave first-time buyers facing less of a financial hurdle in terms of mortgage and deposit payments."

JUNE SEES 7% MONTHLY FALL IN FIRST-TIME BUYER TRANSACTIONS

There were 21,100 first-time buyer completions in June 2015, 7% lower than 22,700 in May and 27.2% lower than a year ago.

Meanwhile, the average purchase price of first-time buyer properties was £154,041 in June, a figure unchanged compared to a year ago and down 0.9% on a three-month basis. First-time buyer deposits averaged £25,926 in June, 1% less than a year before, but 2.8% higher than three months ago and 2.1% higher than last month’s average.

However, the latest Mortgage Monitor from e.surv revealed that the total number of high LTV house purchase approvals has rocketed 18% between May and June of this year and has grown 6% compared to June 2014. This suggests that the number of first-time buyer completions should return to growth over the summer months.

Adrian Gill concludes: "First-time buyer numbers have had a disappointing month, with little sign of the anticipated post-election bounce. Many would-be first-time buyers deferred their decision until after the Chancellor’s Summer Budget, one which essentially laid out the Government’s economic and housing policy for the next few years. However, deposit costs continue to rise – while this may be frustrating for those diligently saving to put a foot on the ladder, it is a positive reflection on the growth of wages and home values. More positively still, the surge in high LTV house purchase approvals should mean a rise in completions in the coming months. It’s a matter of waiting for the emerging signs of growth to filter through the property chain."

REGIONAL DIFFERENCES

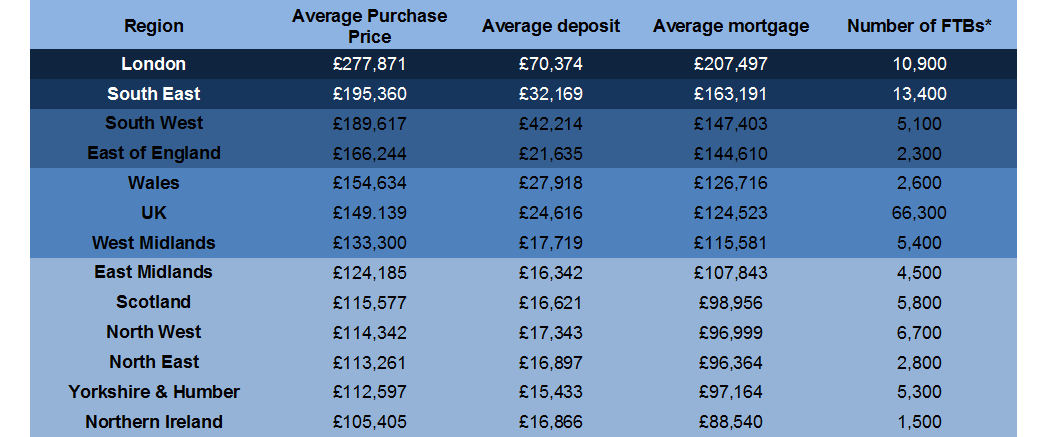

The average purchase price paid by first-time buyers in London was £277,871 in Q2 2015, while Northern Ireland was the cheapest region for first-time buyers at an average of £105,405.

* This is the total number of FTBs in Q2 2015. Based on CML regional data (released 20th July 2015) on the number of FTBs in Q1 – grossed up to reflect growth in FTBs recorded by Your Move and Reeds Rains between Q1 2015 and Q2 2015.

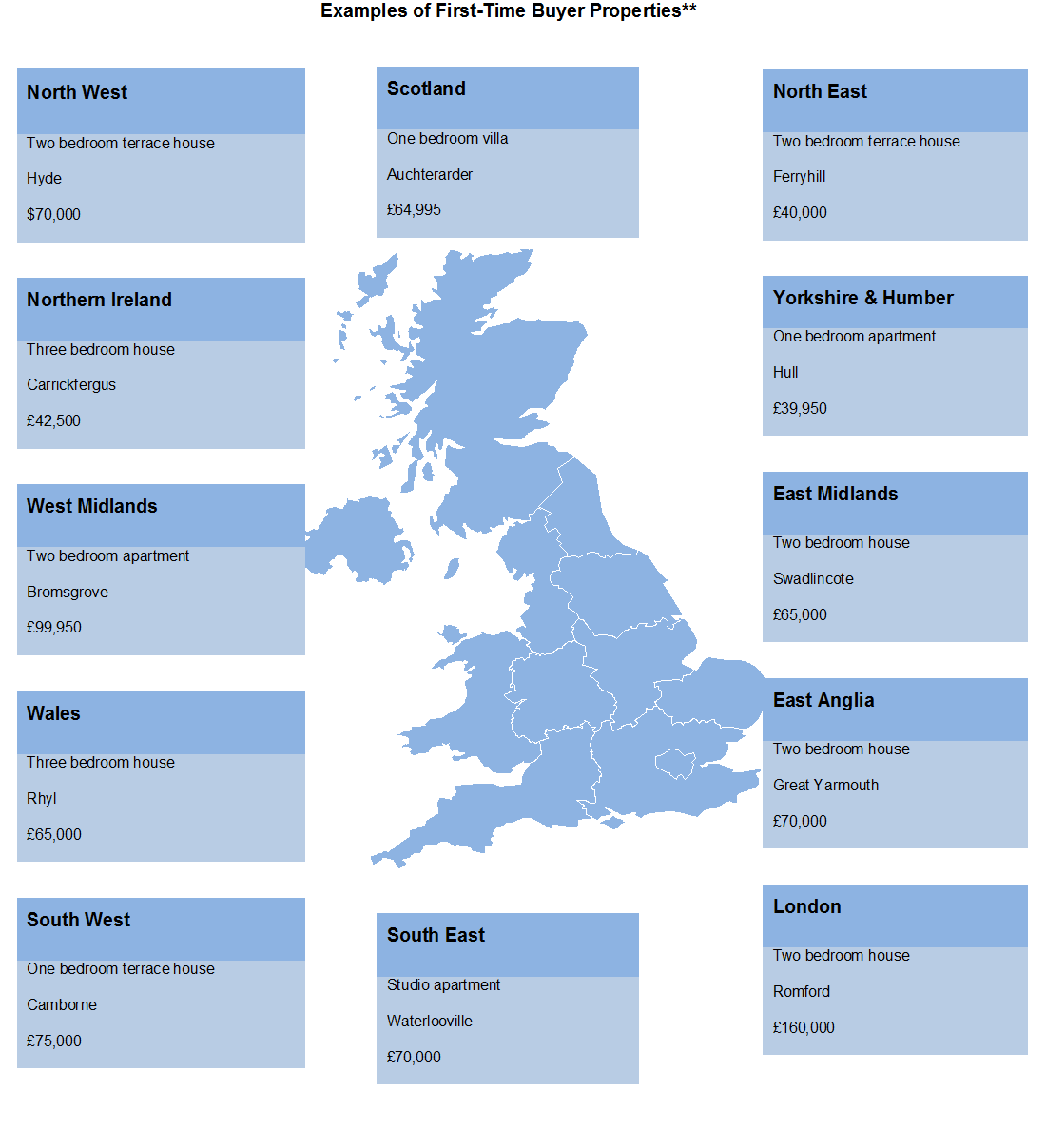

Examples of First-Time Buyer Properties**

** Properties on the market with either Reeds Rains or Your Move estate agents at the time of going to press.

Courtesy of LSL.

Methodology

LSL uses the extensive monthly data from registered first-time buyers in its estate agency brands Your Move and Reeds Rains to update the CML’s first-time buyer data before the CML’s RMS data is published. The term ‘first-time buyer’ is here denoted by the purpose of a buyer’s registration, rather than their LTV. LSL LTV data has been applied to CML price purchase data to calculate deposit and affordability information. Sentiment and salary data are derived from a survey conducted by LSL. The figures are not mix or seasonally adjusted, and are subject to revision as more data becomes available.

This First Time Buyer Opinion Barometer has been prepared by Instinctif Partners for LSL Property Services. It has been compiled using information extracted from LSL’s management information. The copyright and all other intellectual property rights in the First Time Buyer Opinion Barometer belong to LSL. Reproduction in whole or part is not permitted unless an acknowledgement to LSL as the source is included. No modification is permitted without LSL’s prior written consent.

Whilst care is taken in the compilation of the First Time Buyer Opinion Barometer, no representation or assurances are made as to its accuracy or completeness. LSL reserves the right to vary the methodology and to edit or discontinue the First Time Buyer Opinion Barometer in whole or in part at any time.